Peter and I have been having a few of those serious, and not so fun conversations about money lately. After making the switch to a one income family, we are doing okay, but we could be doing better. We have plans and goals and over the past few months we have lost track of those things. So it is time to get back on track!

A few years ago we were introduced to Dave Ramsey's Total Money Makeover. We wanted the freedom that his book said was possible. So in January of 2009 we started Our Total Money Makeover. We sacrificed a lot in those first 6 months of 2009. We ate beans and rice for 6 months and paid off a HUGE amount of debt in this time! It was really incredible to see what we could do when we put our mind to it! Dave Ramsey's plan really did work!

In July of 2009 we felt God calling us to adopt. Little did we know that there is no way we would have qualified had we not worked our behinds off paying down our debts. It was at this point in time that we stopped pouring all of our spare money into paying down debts, but instead focused all of our spare money to the $33,000 we would need to complete our adoption. Fortunately, we had so many people come forward during the adoption process and help us get Malachi home!

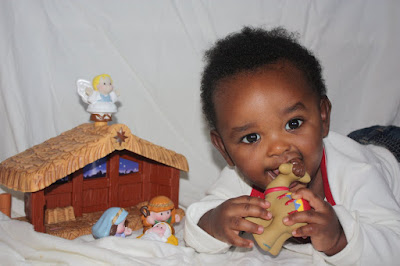

After Malachi came home in August of this year, we had a lot of new changes. Our savings was greatly depleted, we had to start budgeting for diapers and formula, and we became a one income family. Plus we were expecting another little bundle who would also impact our budget. A lot of big financial changes, but everything was so worth it to bring Malachi into our family!!!

We have been undergoing so many new changes in the past few months that our focus has not been as closely on our budget as it should be and we are getting careless. I wish we could live with our head in the clouds forever, but we can't and we probably don't want to. We have goals and we want to get back on track to reaching those!

So with that being said, we are refocusing as we go into 2011. We want to proceed with the intensity we had when we started our Total Money Makeover 2 years ago. So we are pressing on with a very tight budget for the first 6 months of 2011! We don't have nearly as much money to throw at our debt as before, but we CAN sacrifice more.

So as a refresher for those of you who don't know what a Total Money Makeover looks like, it consists of 7 baby steps to financial freedom!

Baby Step #1: Get $1000 in savings as quickly as possible.

Baby Step #2: Pay off all debts besides mortgage. Starting with the debts with the lowest balances.

Baby Step #3: Get 3-6 months of income in savings.

Baby Step #4: Start putting 15% of household income into retirement accounts monthly.

Baby Step #5: Start college savings accounts for children

Baby Step #6: Pay off home early

Baby Step #7: Build your wealth and give more to others!

So where are we?!? Currently we are working on Baby Step #2. We have 2 debts left - a car loan and a student loan. We are very hopeful that within the next month we will have paid off our Jeep and we are very excited about that! Then we are going to take a slight detour. With our current family situation, we feel we need to move on to Baby Step #3 at this point and get 6 months worth of expenses into savings before proceeding with paying off the student loan. If Peter were to get laid off, we would have nothing to fall back on right now and with our desire to stay a one-income family we really need that 6 month cushion in savings. The great news is with the help of the adoption tax credit we will be able to put a huge chunk of the 6 month expenses into our savings account! I really think we will be back to paying off that last student loan sooner than we think :)

So back on track we go! We really want to do this and when we get focused on something, we do an awesome job! It was actually quite fun to watch the debts dwindle down every month and to see that eating beans and rice everyday really was worth it :)